Welcome back to the blog! Today, I am going to be talking about the various obstacles and threats to achieving what you want financially, and how to avoid falling into traps that can keep you from achieving your goals.

Throughout your life, there are going to be many things that try to throw you off course, and that is true of life in general as much as in your financial life. I will go into topics such as gambling, debt, reckless investing, and more. I hope to shed light on this topic, which is one that seems to get glazed over in most public schools. Most fresh college graduates will start their adult life with no experience or knowledge on what to do and not do when managing their own finances. I hope that this blog topic will help to give you an understanding of what to avoid and be careful of throughout college and beyond.

Gambling

Gambling is something that I have seen throughout being in college is something more and more college students are taking part in. Sports gambling is where I have personally seen so many friends start to enjoy and habitually do. Sports is something every college student(typically) enjoys and the feeling of having something riding on a huge game, or let’s face it… any game, is addictive. This is the first threat to your finances that I want to talk about.

I am going to start this by saying I am not wanting to put down anyone who gambles, but I want to simply warn you that there could be dangers to gambling if you don’t do it in a safe way. I will use my dad for an example of a relatively safe strategy of gambling. He has played a lot of poker over his lifetime and when he plays at a casino or in a tournament, he only uses his winnings to buy in each time he plays. When he was starting out, he also would set boundaries of how much of a loss he was willing to take before he would walk away. When you gamble, you need to take the emotions out of it or else you will end up losing way more than you should. This strategy can be applied to gambling at a casino or sports betting.

Many of the most successful investors have had to realize that you can’t be emotional or reliant on your feelings when you invest. This is a common theme throughout the whole world of finance, and it doesn’t stop with investing as we can see. Being emotional with gambling can cause you detrimental losses and throw off your financial future. Especially if you become addicted and can’t find a way to stop.

I don’t want to scare you, like I said, but I want you to be aware of what can happen if you aren’t careful. I have seen through my dad that gambling can be a great form of entertainment, and even can result in winning some money. In order for it to not harm your financial future, though, you need to set boundaries with yourself.

Debt

Debt is something that almost everyone is going to incur at one point or another in their lifetime. Whether it be a mortgage, car payments, credit cards, or student loans, you will experience, or have already experienced some form of debt.

There are some forms of debt that are actually very advantageous, though, and those cannot be ignored. For example, credit cards have a lot of advantages that can be utilized. Credit card perks for cash back, travel, and reward points make credit cards a less “threatening” form of debt if you use it properly and do not allow yourself to spend beyond your means to a point that you cannot pay off your bills.

Credit cards have many perks that make them extremely useful, but they also have the potential to wreak financial havoc on your life. The interest rates are extremely high on most credit cards, which is why so many people who dig themselves into a hole of credit card debt cannot find their way out. According to WalletHub.com, the average credit card interest rates for new offers(getting a CC for the first time) is 21.81% for 2023. Getting yourself behind on payments, and having that interest continue to grow can be devastating.

Next, mortgages and car loans are two forms of debt you will likely experience in your life and you have to be prepared when taking on these forms of debt. The interest rates will be much lower on mortgages and car loans, but if you take out a loan and the monthly payments are much higher than you can afford, you have the potential to ruin your credit score and not be able to keep your house or car. I don’t want to say this to steer you away from taking out any loans for a house or a car, but to urge you to be prepared and research when you want to take out a loan. As a general rule, I would suggest that you keep all debt under around 40% of what your income is each month.

Student loans are something that you may have currently, and I hope to write a more expansive blog article on this later. I will say that having student loans can be intimidating and seem like you are trapped in a hole, however if you can seek out scholarships and stay on top of payments once you are out of school, they can be manageable. Living within your means and spending money only on the necessities when you get out of college can make them even more manageable as well.

Reckless Investing

Reckless investing is something I have seen many college students take part in to try and make money, or even have the appearance that they know how to manage their finances well. You may wonder what “reckless investing” is. Reckless investing is very broad and can include different habits, but I view it as purely investing based on emotions(similar to gambling), and trying to pick stocks without doing any or little research.

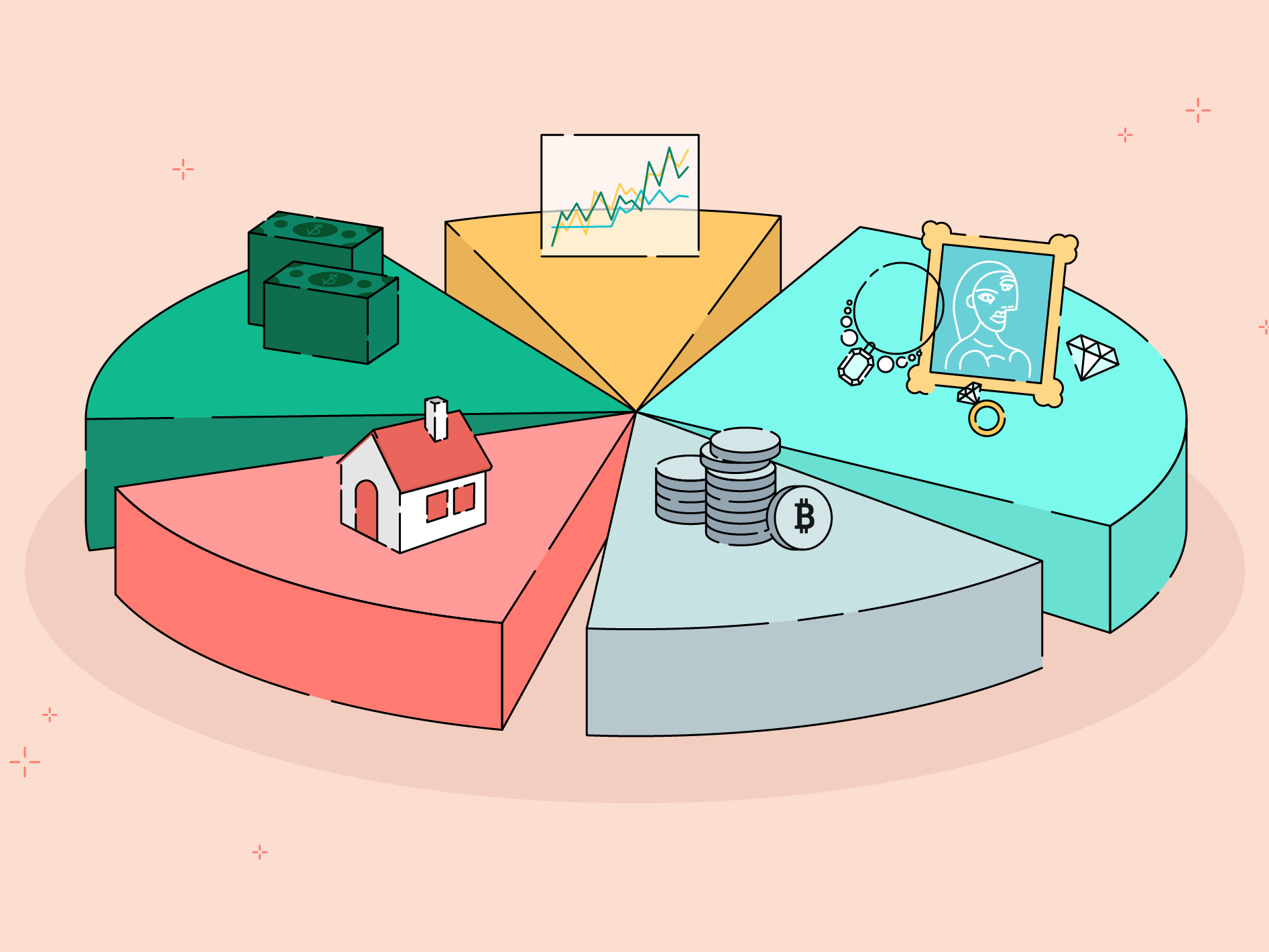

I will get more into why picking stocks can be risky, even with research, but for now all that needs to be said is that it is incredibly hard if not impossible to pick individual stocks successfully. Especially if you put little or no effort into doing it. Investing is very simple if you are invested in a variety of different stocks, bonds, etc, but by picking certain stocks and not expanding your investments, you get exposed to a lot of risk, and put yourself in danger of losing a lot of money. I will talk extensively in my next post about what it means to “diversify” what you invest in. This is the smartest way to invest in the long run, and experience the smallest amount of risk.

As you can see, there are many threats to your finances, and I hope you feel more informed and prepared on how to handle them. What makes these threats complicated is that many of them(debt specifically) have perks to them such as credit card perks, and if you get lured in when you shouldn’t it could lead to the downfall of your financial future. If you approach your personal finances informed, keep emotions out of it, and have a general plan, you will tackle many of these problems before they even begin!

I hope you have enjoyed the blog so far and will continue reading! In two weeks I will be talking about diversification and how important this discipline is when you begin investing. Following that, I will post about stock investing!