Why You Should Invest Your Money

The answer may seem obvious to most people… to make more money. However, this is a more complicated answer than you may think. It all depends on the goals you have set before you. Different people have different goals for their life in mind. This is why if you have ever talked to any type of financial advisor the first thing they will talk to you about is what your goals are and what risk levels you are willing to take. Understanding your individual goals is the first step into understanding why you should look to grow your money, because without a purpose in wanting to invest and grow your money there is no point in even doing it in the first place.

What can be really beneficial is writing down financial goals for different time increments such as the next year, 5 years, 10 years, and even when you want to retire and what you want your lifestyle to look like along the way. This will help you to gain a clearer picture of why you are investing and actually understand that the reason to invest your money is not simply to get more money with no reason or goals in mind. In my life, for example, I want to be able to provide for my family 5-10 years down the line as well as being able to buy a house in that timeframe. 20 years from now I will have to buy a new car and also have kids. Along the way, I want to be generous with my money and use some of it to tithe to my local church or a charity that is special to me.

Another reason that you should look to grow your money is inflation. I am sure that you know what inflation is, but a lot of people don’t understand that having your money in a savings account and simply putting money in that every once in a while is not enough to combat inflation. You need to be actively growing your money, while also adding money to it yourself to be able to truly combat the effects of inflation… especially in this day and age where the dollar is worth practically a fraction of what it used to be.

Inflation and personalized goals are the two most important reasons why growing your money should matter to you. At the end of the day, you don’t have to invest your money to meet your goals, however, if you look at the numbers of where inflation is heading and how expensive long term goals are to achieve, it is nearly impossible to achieve those long term goals without passive growth to your income through investing.

How to Start Investing Your Money

This question is a little more complicated and I will answer it at a more shallow level right now. To start you can either get a broker or financial advisor to invest on your behalf(with a larger cost of course), or you can invest yourself through sites such as TD Ameritrade, E*Trade, Fidelity, etc. This would be how one could invest in the stock market, bonds, or commodities. Once you start to make a few trades and you own stocks of a company or some bonds, this will make up your portfolio. Various pre-packaged portfolios may also be purchased to help make your investing simple based on those goals and risk levels we talked about before. This would be the way most people beginning to invest would start out, especially if they don’t want to pay the extra fees for a financial advisor or broker. To do this, it would be as simple as creating an account through a site like Fidelity, link your bank account to it, and begin trading.

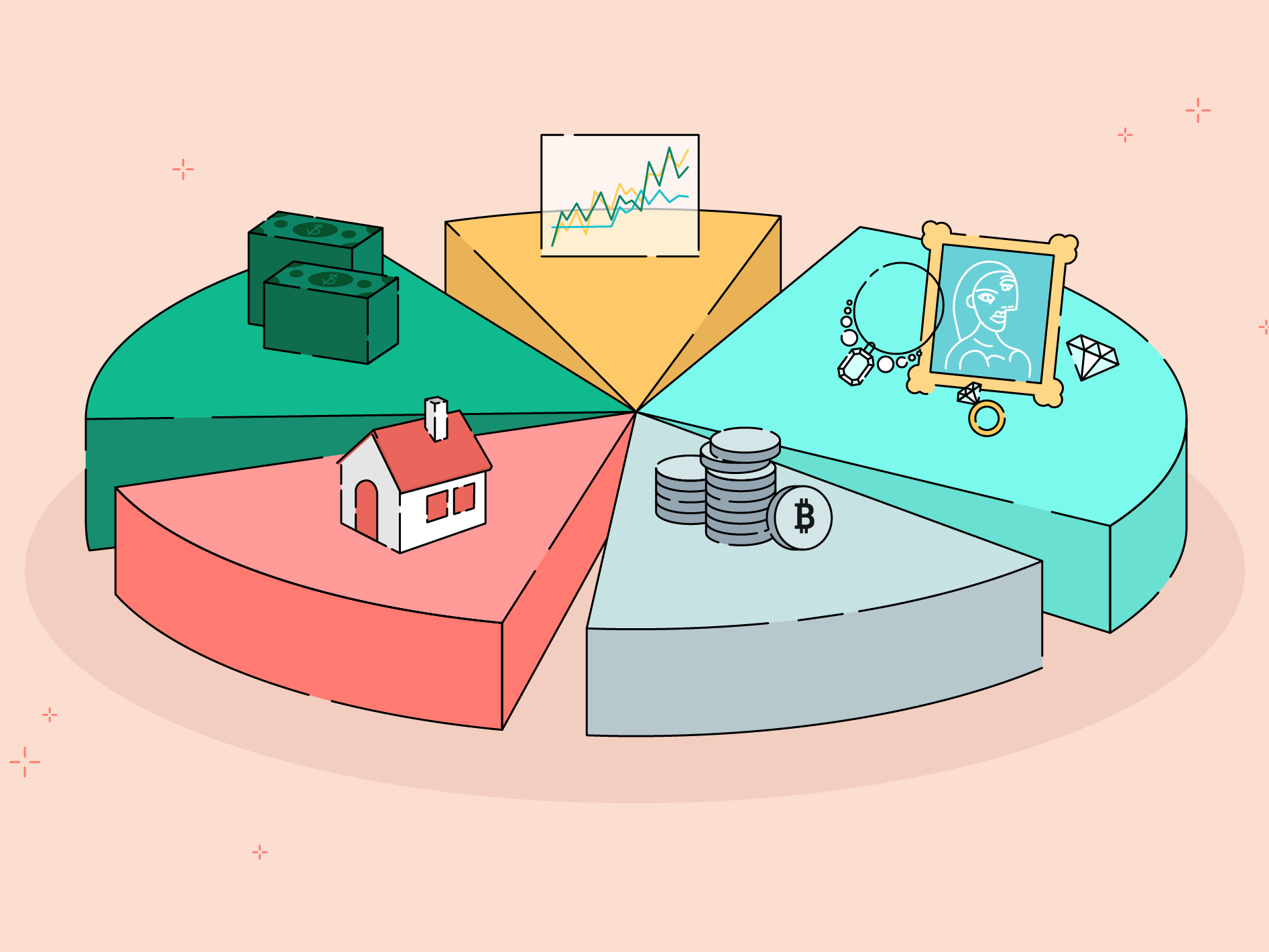

For some people, they may not want to get into buying stocks or bonds and the real estate market may stick out to them a little more. This can, of course, also be done through websites selling properties that you can invest in or through a broker/realtor. Real estate investing requires much larger initial capital to begin financing and investing. However larger the barriers to entry to real estate are, it can be extremely worthwhile if done correctly. REIT’s(Real Estate Investment Trusts) are another stock-like option to invest in real estate, and I will detail this more when I talk about real estate investing later on. In this blog I will focus much more on equity investing(stocks), bonds, and even some private equity. Investing in private equity is an alternative form of investing in which you may invest in a fund through firms like Blackstone, where they buy other companies and essentially flip them and turn them into profitable companies and sell them back to gain profit for the investors in the fund.

As you can see, there are a number of ways to invest your money and lots of them are quite simple to get started with. During this, I will go into more detail on each of the ways to invest your money, strategies to avoid risk while exposing yourself to high growth opportunities, and how to succeed in getting through the hard parts of investing.