What are Stocks

Stocks represent partial equity in the company you invest in. This ownership comes in exchange for your money. Below I have an illustration of how stock ownership works if this concept isn’t sticking too well.

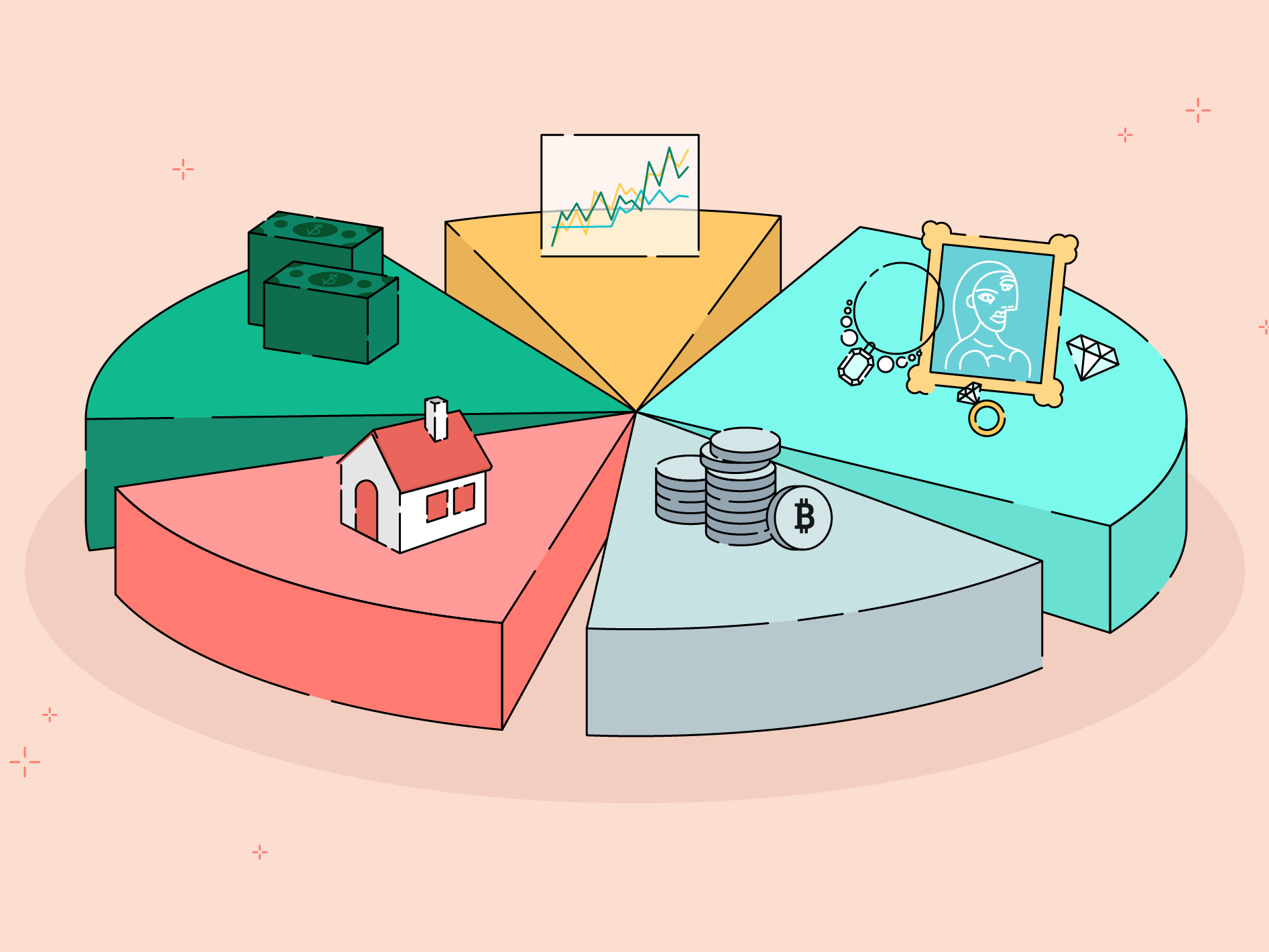

People can make money by investing in stocks in two ways. The first is when the company pays you a dividend in exchange for having equity in the company. Many companies don’t pay dividends to its shareholders, however, so most of the time individuals pay more attention to capital gains that they can receive from buying and selling a stock at a profit. Stock prices move according to demand(purchases vs. sells) of the stock. Like anything, you want to buy low and sell high, but in reality this is incredibly hard(if not impossible) to predict. This is why diversification is so important(If you want to read more about diversification, click HERE to read my post about it in detail). I will go into strategies, and more specifically, funds that will help you diversify and avoid the volatility and risk of buying and selling single stocks.

Index Funds

To begin the discussion on diversifying when you invest in stocks I will introduce something called a stock market index. Indexes are a benchmark at their core. One of the largest indexes in the US is the S&P 500 and it holds the 500 largest companies in the United States, and the larger the company the more weight it holds in the index. Index funds are one of the ways that you can invest using stock indices to diversify and get exposure to all of the stocks in the index without having to buy them all individually. More specifically, when you buy the index fund you are buying small parts of all of the companies in that index and like I said, the larger companies make up a higher percentage of that index fund.

Why are index funds such a good investment, though? The stock market on average goes up 10% year after year, and these indexes aim to achieve the same returns as the market. This is also why investing early is so important, because the market occasionally experiences very low lows and very high highs as well, and remaining invested for a long period of time will more accurately average out the returns to around 10% per year.

Within your Roth IRA or taxable brokerage account you will be able to trade these funds. Some good index funds include VTI(a total market index fund), VOO(S&P 500 index fund), and FNILX(large capitalization index fund with no expense ratio). This is of course, not licensed advice and I am not responsible for losses incurred from investment in these assets, they are simply suggestions to start investing. Many other funds(sometimes listed as “ETFs” AKA exchange traded funds) exist and track many other indexes or types of companies such as emerging companies, international stocks, and other indexes like the Dow Jones, NASDAQ, and Russell 2000.

Overall, index funds provide an easy and cheap way to invest your money without having to research stocks or try to “beat the market”. Index funds are a great “put it away and don’t worry about it” type of investment. It takes the emotional part out of investing, because people can easily get attached and base their investments based on feelings rather than trusting how the market will grow over time like I got into earlier.

Fees

Fees are one of the things that you must be aware of when deciding what to invest in. There are more types of funds than just index funds, and that is called a mutual fund. Mutual funds are actively managed funds which means that the fund avengers are picking stocks to have in this fund and not seeking to simply track an index. According to CNBC, last year around 80% of fund managers did not achieve greater returns than the stock market indexes. This shows how investing in these index funds is riskier as a whole, but also even when they achieve equal to or higher returns you are paying them more money in fees. Most funds(even index funds) have something called an expense ratio, which is the percent of your investment in the fund the fund manager takes from you each year. Mutual funds have expense ratios around 1-2%, but index funds typically have expense ratios between .03% and 1%. This means that these mutual funds must outperform these market indexes by the difference of their expense ratios in order to even provide the same returns to the investor.

You can find the expense ratios for index funds just by looking it up on yahoo finance as seen below. VOO, as I mentioned before, has an extremely low expense ratio, which is another reason it is such a good investment.

Another way to find it is by clicking on and searching up these funds on the site that you invest through. Comparing similar funds’ expense ratios is a great way to ensure you are getting the absolute most out of your investments.

Sources